【导语】有没有感觉现在的投资人越来越多?到底是为什么,现在有这么多的投资人呢?一个纯美国视角,看到的是全世界VC行业的崛起。本文翻译自投资机构KPCB的合伙人Eric Feng的英文博客,完全的数学视角。以下为硅发布翻译简写。

我一位刚刚在风险投资行业耕耘满15年的朋友说:她刚做这一行时,独来独往,基本很少和其他的投资者互动,但是现在,和她一起工作的投资人就有好几百,而且,这个数字每年还在涨。

这是过去15年来风投行业被改变得最多的一个地方。那么,到底是为什么投资人会越来越多呢?

让我们用数据来挖掘一下。

种子基金数量疯狂增长

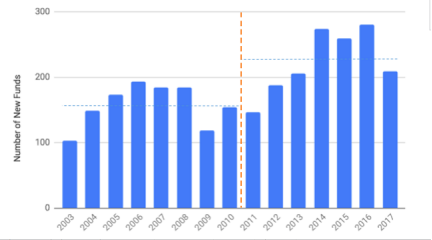

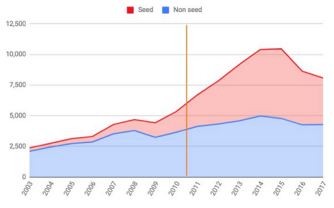

借助投融资数据平台Pitchbook,我做了两张图。第一张图如下,这是自2003以来,美国每年新成立的基金数量。

可以看到:2003-2011年,平均每年美国新募集的基金是157支。但是自2012年开始,这个数字上升到了223支(也就是42%的增长)。而更多的基金,也就意味着,更多的投资人。

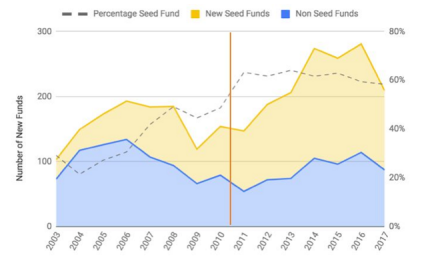

但是,这些新成立的基金都是些什么类型的基金呢?下面是我做的第二张图。

过去15年,每年筹集的“非种子基金”(即VC和增长型基金,为下图蓝色部分)在新基金总盘子里的占比情况相对稳定,约为90;而种子基金的占比情况(为下图黄色部分),却戏剧性地上升。

2003-2010年,美国平均每年新成立的种子基金是58支,但是2011-2018这七年里,平均每年新成立的种子基金达到了137个(增加了2.3倍)。

换句话说:美国最近这些基金数量的增长,其实都来自于种子基金,而不是VC或者增长型基金。

而大概是从2011年开始,美国每一年新筹集的基金中,种子基金占到了60%(十年前,这一比例还不足30%)。

而因为每年的新种子基金数都在不成比例地增长,做种子投资的人也就有了更大的增长。因此,如果你觉得你的身边都是投资人,尤其是做种子投资的投资者,那么原因就是:他们真的”存在“。

交易

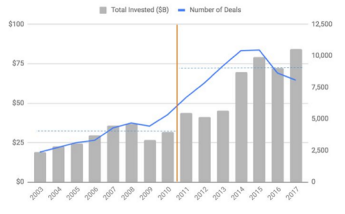

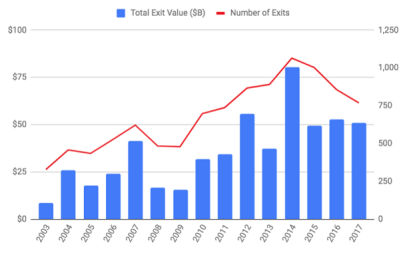

再来看看第三张图。

2011年之前,平均每年美国VC投给创业公司的钱,是$280亿,但是过去7年里,这个数字跃升到了$620亿。而去年,美国VC投给创业公司的钱,增长了4倍之多,达到近$850亿。

当然,交易笔数也急剧增长。2003-2010年间,平均每年做交易3800笔,但自2011年以来,平均每年交易笔数飙升到了8700笔以上。

这个时候,当你看到在全部被投出去的钱里面,也就是总投资金额里,其中,非种子基金的交易,占到了总资本的90%以上,并且这个比例,一直不变地保持了十年,那么你基本可以看到:即便是有大量的种子基金涌入,但是大部分的钱,仍然是由传统VC和增长型基金投出去的。

而如果我们研究的是交易笔数(而不是总金额),则出现了一个完全不同的故事。

在这个故事里:过去10年,非种子交易笔数增长了20%;同一时期,种子交易笔数增长了400%。事实上,自2011年以来,平均每年种子交易笔数是4300,大约等同于现在每年非种子交易笔数的平均数量——4500。

换句话说:当种子和非种子交易加在一起时,现在,融资活动的活跃度比15年前要多上3倍。而如果我们做一下数学:现在,每一个小时,就有一笔风险投资交易发生,每周七天,都是如此,一年365天都是如此。

确实,投资人很忙。

退出情况怎么样?

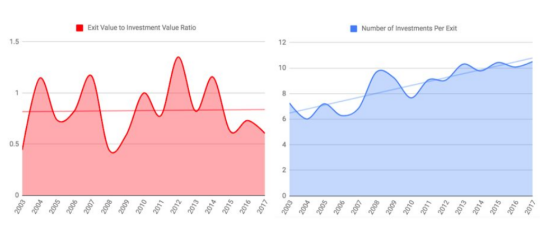

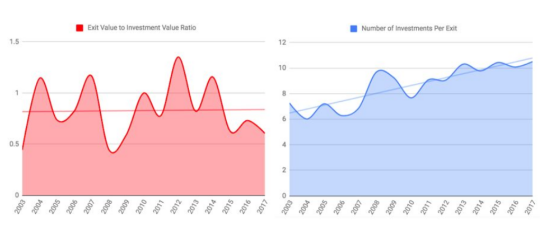

那么,风投们的回报情况如何呢?答案是:相当不错。

过去15年中,退出(上市或者被收购的初创企业)总数,增加了2倍。而自2015年以来,退出公司的总价值增加了3倍,达到平均每年$500亿的回报。

但是,这些数字是有误导性的。因为实际上,这些年投出去的钱和所做的交易笔数,也都有增加。所以,这里真正有价值的描述其实应该是:相对值,而不是绝对值。而如果你这么去算,那么情况就更具挑战性了。

下面有两张图。左边,是我绘制的一年回报总金额,除以当年投资的总金额,并包括了趋势线。

我发现:比率近似于投资美元的回报,几乎是平的,这表明:VC的投资收益,相对于投出去的钱,保持不变。

保持不变现在是件好事,因为它表明:随着更多的钱进入市场,风险行业能够维持自身。换句话说:尽管现在在这个系统里走的资金,大约是过去的3倍,但是现在的投资回报率,与15年前大致相同。风险投资已经能够规模化为一个产业。

但是右边的图,情况变得棘手了。这个图我绘制的是:一年以来,投资交易笔数,除以当年的回报笔数,并包括了趋势线。

这个比率能够得出的结果,代表在这个行业工作的人,到底需要做出多少笔投资,才能得到一个比较好的回报。

结论如下:

在15年前,平均说,一个风投大约需要做7个投资,才能够得到一个回报。但是现在,平均需要做10个。也就是说:今天的投资者,有10%的可能性,作出一个能够产生回报的好投资。而昨天的投资者,这种可能性是15%。

换句话说:昨天的投资者,投资于”正确“公司的可能性,要比今天的投资者高了50%。我们说从长远看,准确率提高了50%,是去年NBA最好的三分球手和最差的三分球手(132名合格选手中)的区别。

大满贯游戏

那么,当更多的基金在向更多公司投更多钱会发生什么呢?

当这个行业,与15年前相比,每一年发生的投资交易笔数多出5000笔时(其中大部分是种子投资),这里就会存在很多的创业公司,他们都拿到了钱,然后,投资人做评估。也就是说,创业公司的池子更大了。

那么,当美元加权回报得到的比率大致不变,但是选择公司的难度却大幅地增加,现在,做风险投资这行还有啥意思呢?换句话说,为什么有那么多的基金和投资人蜂拥进这个越来越难得到胜利行业?

原因是:一旦你赌对了,你得到的“胜利”将比以往任何时候都要大。

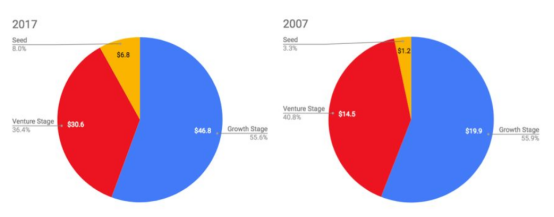

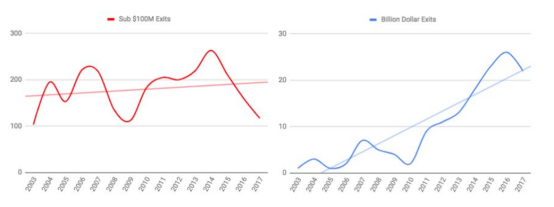

为了说明这一点,我在下面的图表中,绘制了这15年来,发生的两类退出。左图,是每年退出价值低于1亿美元的公司情况,可以看到:趋势线只是轻微上升。但是我们来看右图,每年退出价值超过$10亿的公司情况呢?趋势线,是急剧上升。

平均来说,相比10年前,现在公司退出价值达到$10亿的公司数量,是十年前的7倍之多。

在去年总退出公司的数量中,退出时价值达到$10亿的公司数量,占到了总退出公司数量的10%,但是你知道吗?这个小小的团体,在金额上占了总回报的60%。

正如投资者马克.安德烈森所说:“回报是幂律分布”,大部分的回报,都集中在少数公司身上。这句话比以往任何时候都更真实,也是激励和驱动投资者在这个行业做出伟大承诺的最重要原因之一。

是的,现在投资行业的竞争比以前更激烈,也更很难识别出巨大的投资机会。但是今天的创业公司,也比以前更为成功、更具变革性和更具价值。

现在,回到最初的那个问题:为什么风投行业发展得这么大?原因有很多,而一个简单的事实是:“结果”变得更有意义了。你的下一笔投资,就可能可以引领整整一个行业。与这种赌注一起工作,是一个巨大的动力。如果我们继续把投资行业类比体育行业,如果你是那个可以支持明天伟大公司的幸运投资者,十年前,你有可能打中的“全垒打”,而现在,你有可能打中的是一个“大满贯”。

对很多人来说,这值得玩。

A stats-based look behind the venture capital curtain

“If you can’t invent the future, the next best thing is to fund it.”

— John Doerr, Kleiner Perkins Caufield & Byers

I was catching up recently with a friend who had just celebrated her 15th year as a venture capitalist. We were sitting on a bench in San Francisco’s South Park and during the course of the hour chat, 9 different tech investors we both knew and frequently collaborated with happened to walk by at different intervals.

Pure coincidence, but by no means a rare coincidence, as South Park has in recent years become home to more than a dozen investment firms making it the de facto capital of venture capital in the city. The Sand Hill Road of San Francisco if you will. Or perhaps more accurately, Sand Hill Road may be the South Park of the Peninsula given investors have put about 2 times more capital into San Francisco startups than their Silicon Valley counterparts this year.

As each familiar face passed that South Park bench, we would politely wave and resume our conversation but after the fifth interruption or so, my friend couldn’t help but stop and make a comment. “That’s what’s changed most in the past 15 years. When I started out, I didn’t interact with all these others investors because there wasn’t anyone to interact with. Now there are hundreds of investors I work with, and that number grows every year. I wonder why there are so many more investors now?”

Let’s find out.

Planting seeds

“Seed investing is the status symbol of Silicon Valley.”

— Sam Altman, Y Combinator

To understand as well as visualize the changes that have happened in the venture capital industry over the past 15 years, I’ve pulled together some metrics courtesy of Pitchbook. The first chart below is the number of new US-based VC funds that have been raised each year since 2003. From 2003 to 2011, an average of 157 new funds were raised each year. But from 2012 onward, that average rose to 223, or an impressive 42% increase. More funds equals more active investors working at those funds.

Looking closer into what types of funds are being raised, I’ve taken the same data but broken out the US-based investment funds by seed funds versus non-seed funds (i.e. venture and growth stage funds). The rate of non-seed funds raised each year has been relatively stable for the past 15 years at about 90. But the rate of seed funds raised has jumped dramatically. Between 2003 to 2010, an average of 58 seed funds were raised each year but in the past 7 years, that average spiked to 137 (or a 2.3x increase). Put another way, all the recent growth in the number of funds raised has been from seed funds, not venture or growth funds. And since 2011, a whopping 60% of all funds raised every year have been seed funds (compared to less than 30% a decade ago).

There has been an even bigger increase in the number of seed investors active in this country because of the disproportionate growth in the number of seed funds raised each year. So if it feels like there are thousands of new investors in the industry, particularly seed investors, that’s because there are.

Wheeling and Dealing

“A lot of capital does disrupt venture capital, which is the problem we’ve had as an industry.”

— Sarah Tavel, Benchmark

Now that we’ve established there are indeed a lot more investors with a lot more funds to invest from, what’s happening with this capital? A very obvious answer: it’s being invested.

In the past 15 years, the amount of money invested by US-based VC firms into startups grew more than 4x to almost $85 billion dollars last year. Before 2011, an average of $28 billion was deployed each year but in the past 7 years, that number has jumped to $62 billion invested annually. Not surprisingly the number of deals has seen a corresponding sharp increase. From 2003 to 2010, the industry averaged almost 3,800 investment deals per year. But since 2011, the average number of deals per year has shot up to more than 8,700.

When you look at the dollar amounts deployed, venture and growth stage deals (i.e. non seed deals) have accounted for over 90% of the capital and that ratio has been consistent over the past decade. So even with the sharp influx of seed funds, the vast majority of the dollars are still invested by traditional venture and growth funds.

But by examining the total number of deals (and not the aggregate dollar amounts), a different story emerges. While the volume of non seed deals is up 20% over the past decade, the volume of seed deals is up 400% over that same period. Since 2011, the average number of seed deals per year (4,300) is now about equal to the average number of non seed deals per year (4,500).

While the seed checks may be small (both individually and in aggregate), they are very frequent. And when combined with venture and growth stage deals, there are 3x as many funding events now than 15 years ago. Do the math and there’s now 1 venture capital investment being made every hour of every day, 7 days a week, 365 days a year.

Investors have been busy.

Exit stage right

“Good VCs are great pickers”

— Josh Kopelman, First Round Capital

Investing is only one side of the venture capital equation. The other side is the returns on those investments. So as investment activity has increased significantly over the past 15 years, how have returns faired? As a whole, pretty good. Total number of exits (startups going public or getting acquired) are up 2x in the past 15 years, and the value of those exits is up 3x averaging $50 billion per year in returns since 2015.

But that growth in exits is misleading because the total volume of deals and capital invested is also up. The true measure is when you compare exits not in absolute terms, but relative to investments. And when you do that, the outlook is more challenging.

Below are two charts that compare returns to investments. In the chart on the left, I’ve plotted the total dollars returned for a year divided by the total dollars invested for that same year, and included the trendline. This ratio approximates the return on dollar invested, and it’s pretty much flat showing that venture returns have not increased relative to dollars invested, but instead held constant. Now holding constant is a good thing as it points to the venture industry being able to sustain itself as more dollars have flowed in. In other words, return on investment is roughly the same now as it was 15 years ago despite having about 3x as much money in the system. Venture capital has been able to scale as an industry.

But the chart on the right is where things get tricky. Here I’ve plotted the number of investments for a year divided by the number of returns for that same year, and included the trendline. This ratio approximates how many investments you need to make before you can get a good outcome in the form of a return. 15 years ago, it was about 7 investments made before you got one return. Now that ratio now sits at 10 investments required to get one return. Today’s investor has a 10% likelihood of making a good investment (in a company that will generate a return on that investment), whereas yesterday’s investor had a 15% likelihood. That’s a 50% higher probability that yesterday’s investor would invest in the right company over today’s investor. To put it in perspective how meaningful that is, a 50% increase in accuracy is the difference between the best three point shooter in the NBA last year and the worst three point shooter (amongst 132 qualifying players).

Grand Slams

“Venture capital is not even a home-run business. It’s a grand-slam business.”

Bill Gurley, Benchmark

It comes back to the effect of more funds employing more investors deploying more capital into more companies. When the industry is making over 5,000 more investments each year compared to 15 years ago (with most of those being seed investments), there are just so many more funded startups for investors to evaluate to find the successes. The proverbial haystack has simply grown much larger.

Then what’s the draw of venture capital investing now if the dollar weighted returns are about the same yet picking startups is significantly harder? Why are there hundreds of new funds and thousands of new investors entering an industry that has become increasingly difficult to find the hits?

Because when those hits are found, they are bigger than ever.

To illustrate this, I’ve plotted two categories of startup exits over the past 15 years below. On the left are exits each year under $100 million in value, where the trendline is up only slightly. But on the right, I’ve plotted exits each year over $1 billion in value, and the trendline is up dramatically. On average, there are more than 7x the number of billion dollar exits now than a decade ago. The number of billion dollar exits last year was about 10% of the total number of exits, but this small group generated 60% of the total dollars returned.

As investor Marc Andreessen has said, “returns are a power-law distribution” with the majority of returns concentrated in a small percentage of companies. That’s true now more than ever, and one of the great promises of the venture capital industry that motivates and drives investors.

Yes it’s more competitive than before for investors. Yes it’s harder to identify great investment opportunities than before for investors. But startups companies are also more successful, more transformative, and more valuable than before too. One of the reasons is directly because of the added investor funding available at the seed stage. Additional capital attracts more entrepreneurs who may not have started a company a decade ago. These entrepreneurs can pursue even more diverse and bold ideas that may not have been tried in a previous era. All this extra activity at the early stage may have crowded the investing funnel. But it’s also led to the companies that make it all the way through being some of the best ever.

So back to the original question posed on why the venture capital industry has grown so much? There’s a multitude of reasons but among them is the simple fact that the outcomes are more meaningful, and your next investment could lead the entire industry. Working with those types of stakes is a huge motivator. Because to continue the sports analogy, if you are that fortunate investor who backs tomorrow’s great company, what was a home run a decade ago now has a chance to be a grand slam.

And for many, that’s a game worth playing.